The Patient Investor

Why Invest When The Stock Market Is At An All Time High?

Over the last two decades, the U.S. stock market has repeatedly been making new highs. As a result, this has been a relatively common question that I’ve heard from clients throughout my career. For a client with money to invest, it’s a natural one to ask…”if the market is at an all-time high, why should I invest now?“ And this question is relevant today. On February 19, 2020, the S&P 500 index hit an all-time high, closing at 3,386 as part of a historic bull run that began on March 9, 2009. After a dramatic drop of 34% in March due to the COVID-19 pandemic, the U.S. stock market quickly recovered and the S&P 500 made a new all time-high on August 18, 2020.1

Over the last two decades, the U.S. stock market has repeatedly been making new highs. As a result, this has been a relatively common question that I’ve heard from clients throughout my career. For a client with money to invest, it’s a natural one to ask…”if the market is at an all-time high, why should I invest now?“ And this question is relevant today. On February 19, 2020, the S&P 500 index hit an all-time high, closing at 3,386 as part of a historic bull run that began on March 9, 2009. After a dramatic drop of 34% in March due to the COVID-19 pandemic, the U.S. stock market quickly recovered and the S&P 500 made a new all time-high on August 18, 2020.1

Clients now are wondering if they’ve already missed the rally or would be better off waiting for a pullback to invest. Or, if they are already invested, they may be considering whether they should sell a portion of their portfolio ahead of a potential downturn. If we drill a bit deeper, “loss aversion” is often the fear behind these thoughts, summarized in the concern of “what if I invest today and I lose money tomorrow?”

These are natural concerns to have and healthy questions to ask. As advisors, we look to research and evidence to provide perspective and guide our decisions. The good news is that the data makes a compelling case on why investing at market highs has typically been a profitable decision for investors.

The first piece of data to consider is just how common is the occurrence of making new stock market highs? When analyzing the 1,103 months from 1926 to the end of 2017, the S&P 500 was making new highs one-third of the time! 2 For investors waiting for a pullback, that’s a lot of missed returns. This chart gives a sobering look at the cost of missing out while trying to time the market.

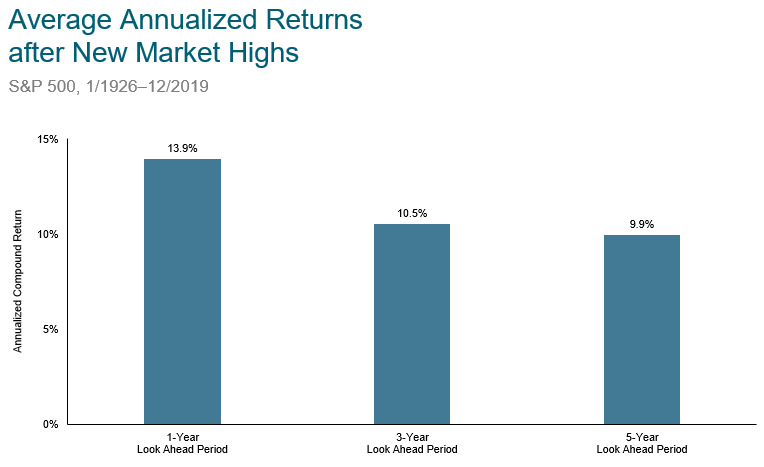

Secondly, research has shown that investing when the stock market is at all-time high has usually been a good decision. The chart provided by Dimensional Fund Advisors, shows that attractive returns were still the norm, on average, even when the market was starting from a new all-time high.3

While our natural biases can make us tentative or worry about whether or not to invest, we rely on research and we believe in the power of business and entrepreneurship—that over time, the stock markets will continue to rise. So the next time the stock market is making a new an all-time high, instead of bracing for a collapse, remember history and the fact that more times than not, the market has continued to do well.

Stay patient, my friends.

References

- The Cost of Trying to Time the Market - Dimensional Fund Advisors

- Investment Discipline - Allodium website

1. Dimensional Fund Advisors, Returns Web

2. Dimensional Fund Advisors, “New Year, New Market Highs” February 2018.

3. Dimensional Fund Advisors. In US dollars. Past performance is no guarantee of future results. New market highs are defined as months ending with the market above all previous levels for the sample period. Annualized compound returns are computed for the relevant time periods subsequent to new market highs and averaged across all new market high observations. There were 1,115 observation months in the sample. January 1990–Present: S&P 500 Total Returns Index. S&P data © 2019 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. January 1926–December 1989; S&P 500 Total Return Index, Stocks, Bonds, Bills and Inflation Yearbook™, Ibbotson Associates, Chicago. For illustrative purposes only. Index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the management of an actual portfolio. There is always a risk that an investor may lose money.

Learn more about Eric Hutchens

Hello! I’m Eric, the president and chief investment officer at Allodium Investment Consultants, located in Minneapolis, MN. I am dedicated to helping clients achieve their unique goals through designing tax-efficient investment strategies and comprehensive financial planning. In my spare time away from the office, I enjoy relaxing at my cabin in northwest Wisconsin with my wife, two sons, and two rescue dogs. I have also volunteered with my church, serving on the elder board and as a youth group leader.

The information provided is for educational purposes only and is not intended to be, and should not be construed as, investment, legal or tax advice. Allodium makes no warranties with regard to the information or results obtained by its use and disclaim any liability arising out of your use of or reliance on the information. It should not be construed as an offer, solicitation or recommendation to make an investment. The information is subject to change and, although based upon information that Allodium considers reliable, is not guaranteed as to accuracy or completeness. Past performance is not a guarantee or a predictor of future results of either the indices or any particular investment.