Institutional Investors - Investment Consulting

Three main reasons for hiring an investment management consultant:

- To provide expertise and/or understanding that you do not have

- To provide guidance and help with difficult investment decisions

- To provide third party endorsement of your investment decisions and actions

At Allodium, we provide non-discretionary investment management consulting services to help institutional investors like you to simplify and improve your financial lives (this particular service is most appropriate for investment portfolios greater than $10 million).

Our investment management consulting process is based on the Prudent Practices for Investment Advisors handbook which was initially published by Fi360 in 2003. Our value proposition for our investment management consulting service is that we can educate you and provide you with objective and independent advice on independent investment managers. We provide no discretionary investment decision-making and allow you to retain complete control over all of the investment policy decisions related to your investment portfolio.

Everything we do at our firm related to investment advice is rooted in the Prudent Practices for Investment Advisors. Officially published in 2003, Prudent Practices for Investment Advisors is comprised of a step-by-step process that ensures that your investment strategy is being properly developed, implemented, and monitored according to both legal and ethical obligations.

Our specific investment management consulting services include, but are not limited to the following:

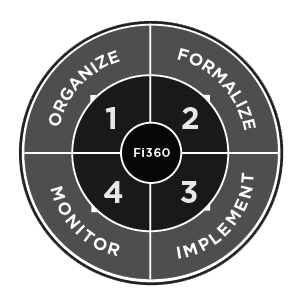

- Organize: comprehensive assessment of financial position and investment objectives.

- Formalize: investment management risk assessment, asset allocation strategy development, clarification of your socially responsible investment (SRI) preferences, investment policy formulation and documentation.

- Implement: investment manager due diligence research, search, selection and deselection.

- Monitor: investment performance reporting, monitoring and evaluating, and periodic investment portfolio rebalancing.

Coordination with Your Other Professional Advisors

We tailor our approach as needed with the institutional investors we work with to accommodate their unique needs and preferences. Our non-discretionary investment management consulting services are best suited for institutional investors with investment portfolios greater than $10 million.

Let's Meet

We invite investors with portfolios over $1 million to a complimentary "Get Acquainted" meeting with one of our financial advisors.