The Patient Investor

What Is Interest Rate Risk and Why Should We Care?

Let’s look at interest rate risk. However, before we can fully understand it, we need to set the stage for where we are currently, as it provides an important perspective on why this matters today. Many people have encountered a falling interest rate in their investment experience.

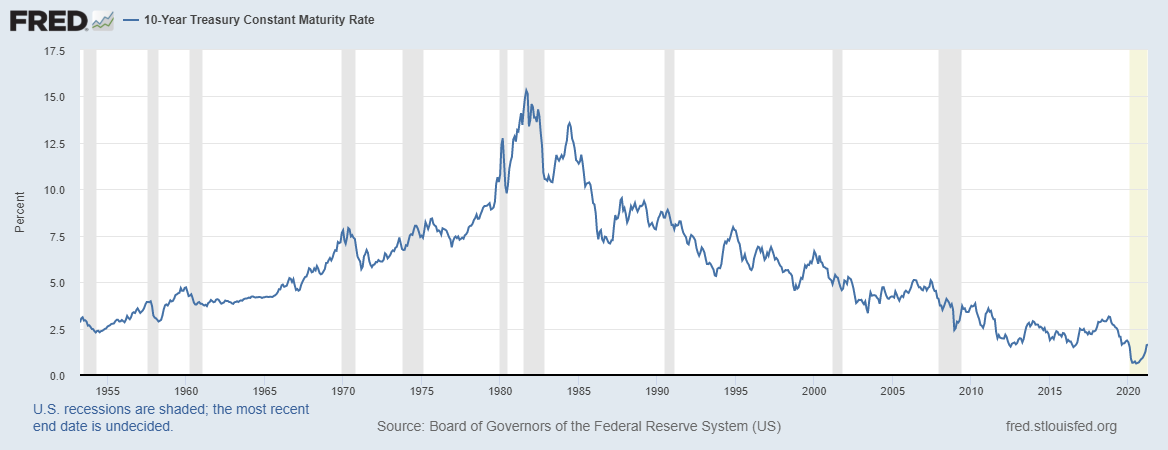

As you can see in the chart below from the Federal Reserve1, the Ten-year Treasury interest rate began falling in the early 1980s, when it peaked at over 15%. While there have been minor upticks over the last 38 years, the overall trend has been downward. You may also note that the 10-year Treasury yield hit an all-time low thus far of 0.32% in March of 2020 and has been moving higher since that time.

Source: https://fred.stlouisfed.org/series/GS10, May 10, 2021

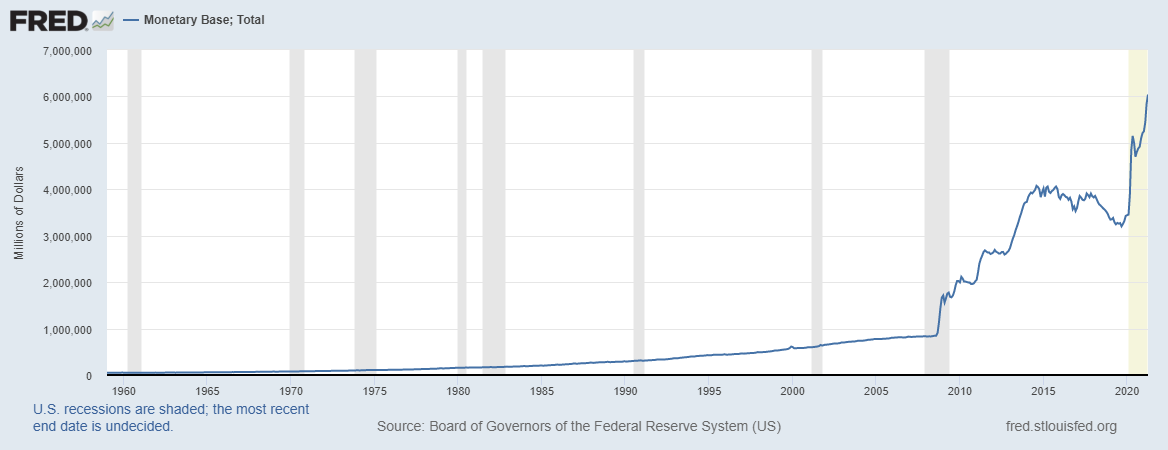

Here’s another chart from the Federal Reserve illustrating the dramatic growth of our U.S. money supply. The surprising statistic is that the amount of U.S. dollars in existence expanded by 25% in 2020 alone. 2 With the economy starting to pick up steam, the coming years may usher in higher interest rates and inflation.

Source: https://fred.stlouisfed.org/series/BOGMBASE, May 10, 2021.

Many investors are unaware that there is usually an inverse relationship between fixed rate bond prices and interest rates. In other words, fixed rate bonds can lose value when interest rates rise—this is known as “interest rate risk.” Since many investors haven’t experienced an extended period of rising interest rates or falling fixed rate bond prices, they may not realize that “safe” bond investments can hurt them financially.

How Interest Rates Work

Let’s consider an example that may help illustrate this concept. Assume you buy a 10-year fixed rate bond, yielding 3% interest for $10,000. You will receive $300 a year for ten years and will get your $10,000 back at the end of ten years —assuming the issuer is still solvent. After two years, you will have eight years remaining on your bond. However, interest rates have risen in the marketplace and an 8-year bond that can now be purchased for $10,000 is yielding 5%. Why would someone want your “old” bond yielding 3% when they could now buy a “new” bond that would get them 5%? The answer is that they wouldn’t— unless your bond was repriced to be sold at a lower price—referred to as “discount” in the fixed income world. Like a teeter-totter, as interest rates rise, the value of fixed rate bonds decrease. In this case, the bond you paid $10,000 for would now be worth about $8,700. You can still hold the bond until maturity, but you’ll have to wait eight more years to receive your $10,000 back.

Duration

The longer the bond’s maturity, the greater the interest rate risk.

Here’s another real-world example that explains this idea. If you have a 2-year fixed rate bond and interest rates rise, you only need to wait two years to receive your principal back. However, if you hold a 30-year fixed rate bond, a substantially longer time frame, that bond’s value losses will be magnified. “Duration” is a term used in fixed income investing to measure this risk.

Duration or “modified duration” is how much a bond will lose in value, given a 1% (or 100 basis point) increase in interest rates. In simple terms, a bond with a duration of 2 loses 2% of its value if interest rates rise by 1%. A bond with a duration of 30 loses 30% of its value if interest rates rise by 1%.

Longer maturity bonds equal higher duration which also equals higher price risk.

Another risk to bonds is inflation. Like interest rates, we’re coming out of a historically low decade of inflation. If we see higher inflation in the coming years, bond values and yields will be less on a real return basis. Put another way, if a bond is yielding 3% and inflation rises to 3%, the real return on that interest payment is essentially 0%, due to the decline in the dollar’s purchasing power.

A Rising Interest Rate Climate

“Chasing yield” can be a futile approach, especially in a high interest environment. As financial writer, Raymond DeVoe Jr., has famously put it: “More money has been lost reaching for yield than at the point of a gun.” Retirees are often targeted by the unscrupulous with claims of high yielding investments. These investments may look appealing as retirees are often looking for a stable source of income. However, the risky nature of this type of investment—where the yield may be more than offset by investment losses—is often not explained.

In recent decades, bonds have worked well to diversify a stock portfolio, partially due to falling interest rates that have boosted bond values. In a climate with the potential for rising interest rates, it is important to recognize the inherent risks of fixed rate bond investing. While fixed rate bonds still play a role in a diversified portfolio, investors may want to look for new strategies to further reduce stock market risk. We recommend broad diversification by asset class as a prudent path when developing your investment portfolio.

Stay patient, my friends.

References

1. Interest Rate Risk - Allodium Investment Consultants

2. Board of Governors of the Federal Reserve System (US), 10-Year Treasury Constant Maturity Rate [GS10], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GS10, May 10, 2021.

3. Board of Governors of the Federal Reserve System (US), Monetary Base; Total [BOGMBASE], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BOGMBASE, May 10, 2021.

Learn more about Eric Hutchens

Hello! I’m Eric, the president and chief investment officer at Allodium Investment Consultants, located in Minneapolis, MN. I am dedicated to helping clients achieve their unique goals through designing tax-efficient investment strategies and comprehensive financial planning. In my spare time away from the office, I enjoy relaxing at my cabin in northwest Wisconsin with my wife, two sons, and two rescue dogs. I have also volunteered with my church, serving on the elder board and as a youth group leader.

The information provided is for educational purposes only and is not intended to be, and should not be construed as, investment, legal or tax advice. Allodium makes no warranties with regard to the information or results obtained by its use and disclaim any liability arising out of your use of or reliance on the information. It should not be construed as an offer, solicitation or recommendation to make an investment. The information is subject to change and, although based upon information that Allodium considers reliable, is not guaranteed as to accuracy or completeness. Past performance is not a guarantee or a predictor of future results of either the indices or any particular investment.