What Is Interest Rate Risk and Why Should We Care?

Let’s look at interest rate risk. However, before we can fully understand it, we need to set the stage for where we are currently, as it provides an important perspective on why this matters today. Many people have encountered a falling interest rate in their investment experience.

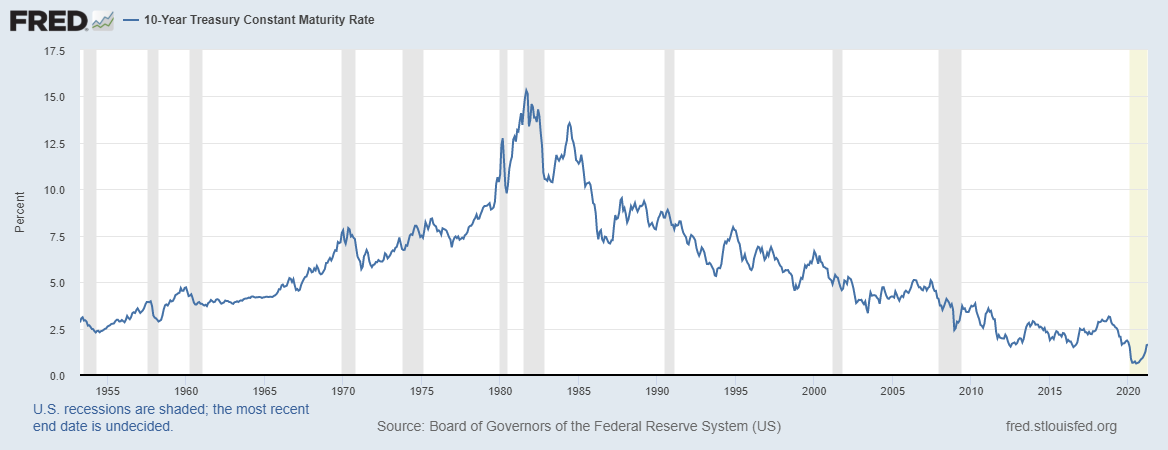

As you can see in the chart below from the Federal Reserve1, the Ten-year Treasury interest rate began falling in the early 1980s, when it peaked at over 15%. While there have been minor upticks over the last 38 years, the overall trend has been downward. You may also note that the 10-year Treasury yield hit an all-time low thus far of 0.32% in March of 2020 and has been moving higher since that time.

Source: https://fred.stlouisfed.org/series/GS10, May 10, 2021

Why Invest When The Stock Market Is At An All Time High?

Over the last two decades, the U.S. stock market has repeatedly been making new highs. As a result, this has been a relatively common question that I’ve heard from clients throughout my career. For a client with money to invest, it’s a natural one to ask…”if the market is at an all-time high, why should I invest now?“ And this question is relevant today. On February 19, 2020, the S&P 500 index hit an all-time high, closing at 3,386 as part of a historic bull run that began on March 9, 2009. After a dramatic drop of 34% in March due to the COVID-19 pandemic, the U.S. stock market quickly recovered and the S&P 500 made a new all time-high on August 18, 2020.1

Over the last two decades, the U.S. stock market has repeatedly been making new highs. As a result, this has been a relatively common question that I’ve heard from clients throughout my career. For a client with money to invest, it’s a natural one to ask…”if the market is at an all-time high, why should I invest now?“ And this question is relevant today. On February 19, 2020, the S&P 500 index hit an all-time high, closing at 3,386 as part of a historic bull run that began on March 9, 2009. After a dramatic drop of 34% in March due to the COVID-19 pandemic, the U.S. stock market quickly recovered and the S&P 500 made a new all time-high on August 18, 2020.1

Clients now are wondering if they’ve already missed the rally or would be better off waiting for a pullback to invest. Or, if they are already invested, they may be considering whether they should sell a portion of their portfolio ahead of a potential downturn. If we drill a bit deeper, “loss aversion” is often the fear behind these thoughts, summarized in the concern of “what if I invest today and I lose money tomorrow?”

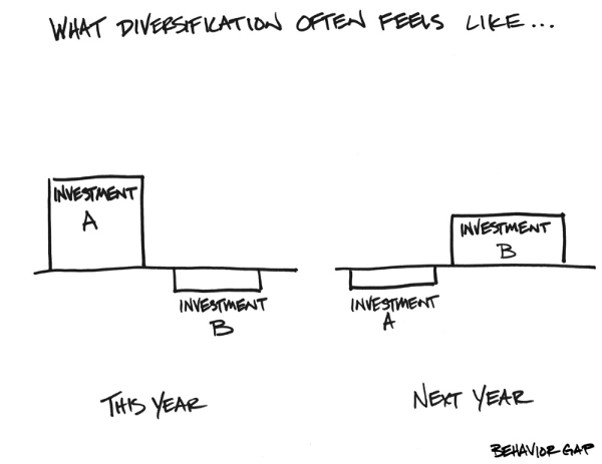

Why Diversify When It Doesn't Seem To Be Working?

Over the last several decades, we’ve seen strong returns from large U.S. companies and a question that many clients have asked is: “Why continue to diversify? Couldn’t we just buy an S&P 500 index fund and get better returns?”

Over the last several decades, we’ve seen strong returns from large U.S. companies and a question that many clients have asked is: “Why continue to diversify? Couldn’t we just buy an S&P 500 index fund and get better returns?”

Dimensional Fund Advisors (DFA) recently posted a terrific blog entitled "A Tale of Two Decades: Lessons for Long-Term Investors" that shares some very insightful data that sheds some light on these important questions.

First, let's look at the numbers over the last decade ... in the chart below, you can see that the S&P 500 (U.S. large cap stocks) had a cumulative return from 2010-2019 that was more than double any of the other listed asset classes. Furthermore, some evidence-based investment managers we use (such as DFA), favor value ("cheap") stocks over growth ("expensive") stocks, as value stocks have been shown to provide excess returns over time. As you can see in the chart below, it wasn't a great decade for value stocks either as the indexes with a value-tilt trailed the market-cap indexes.

Eight Wealth Strategies During the Coronavirus

“The utility of living consists not in the length of days, but in the use of time.” - Michel de Montaigne

“The utility of living consists not in the length of days, but in the use of time.” - Michel de Montaigne

For better or worse, many of us have had more time than usual to engage in new or different pursuits in 2020. Even if you're as busy as ever, you may well be revisiting routines you have long taken for granted. Let's cover eight ways—some effective and others ineffective—to spend your time shoring up your financial well-being in the time of the coronavirus.

1. A Best Practice: Stay the Course

Many investment habits remain the same as ones we've been advising all along. Build a low-cost, globally diversified investment portfolio with the money you've got earmarked for future spending. Structure it to represent your best shot at achieving your financial goals by maintaining an appropriate balance between risks and expected returns. Stick with it, in good times and bad.

2. A Top Time-Waster: Market-Timing and Stock-Picking

Why have stock markets been ratcheting upward during socioeconomic turmoil? Market theory provides several rational explanations. Mostly, market prices continuously reset according to "What's next?" expectations, while the economy is all about "What's now?" realities. If you're trying to keep up with the market's manic moves ... we recommend that you stop doing that. You're wasting your time.

How To Be Positively Skeptical Part 4: Check the Facts Before You Act

“You can outsource expertise but never your understanding, especially when it comes to your finances.” — Ben Carlson, Don't Fall For It

As we covered in the most recent installment in our “How To Be Positively Skeptical” series, there are only so many hours in the day to do all the fact-checking you’d like to when deciding who and what to believe.

How do you approach this never-ending challenge? We suggest conducting your due diligence like a tournament. First, eliminate the weakest contenders, then conduct deeper due diligence on the finalists.

Truths and Dares

This does NOT mean you should disregard all opposing viewpoints. As you may recall from our last piece, confirmation bias causes us to favor information that supports our beliefs and ignore that which contradicts them. But what if your beliefs are mistaken?