The Patient Investor

Considering Private Debt in Diversified Portfolios

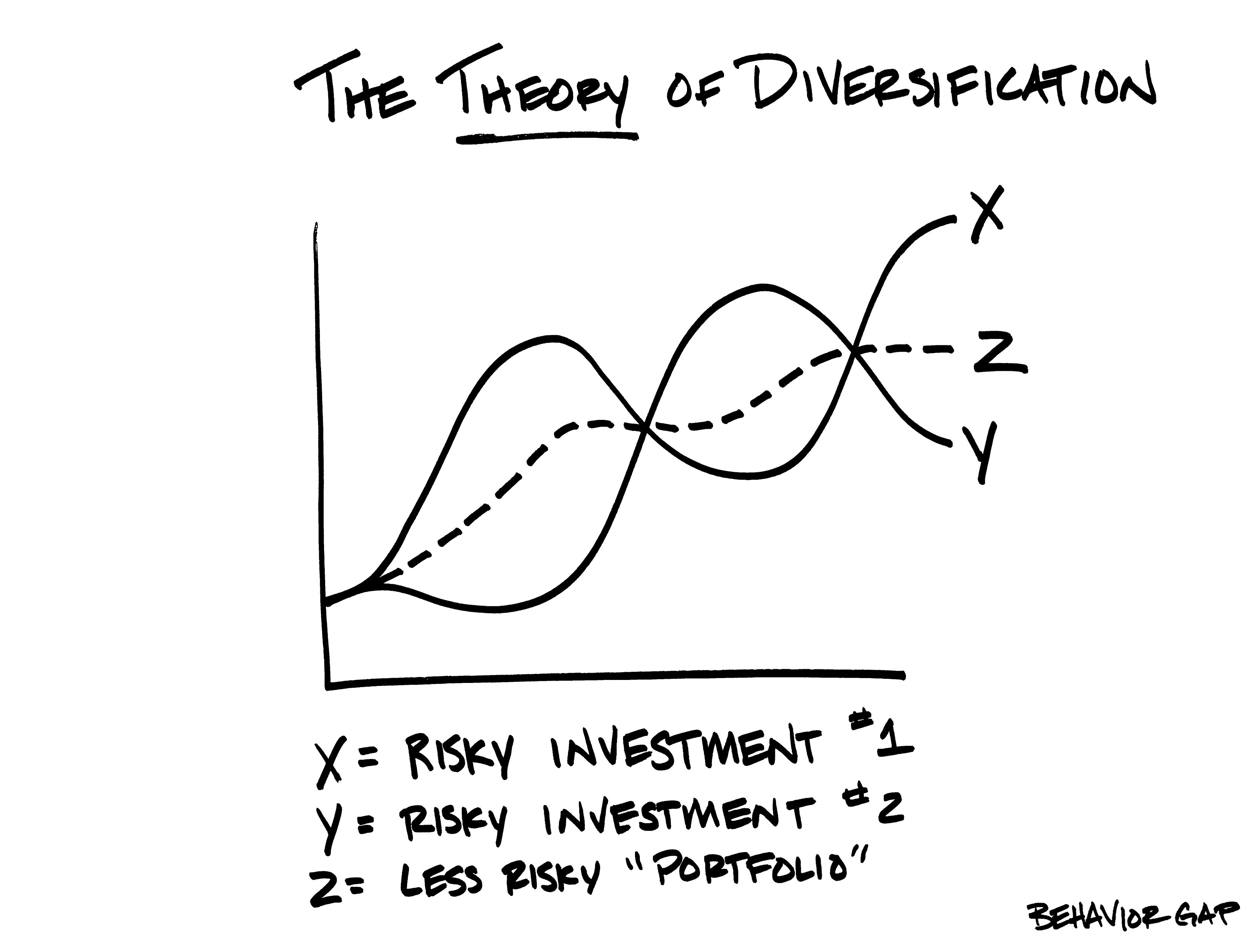

Let’s set the stage by discussing how we think about portfolio construction and why we often look beyond traditional stocks and bonds in an attempt to build more robust client portfolios. Most of our clients' primary objective is to improve their odds of meeting their financial goals, such as retirement. We believe broad diversification helps portfolios because the more asset classes and strategies that provide positive returns over time and diversify one another, the more predictable the portfolio’s range of returns. Furthermore, the more independently each asset class moves related to one another, the closer the correlation is to zero, and the more positive its diversification benefits. The end result of a broadly diversified portfolio is that it should experience a smoother ride over the long run. Carl Richards of Behavior Gap does a nice job of simplifying this concept through the image.

The Allodium Investment Committee analyzes our recommended asset classes, strategies and portfolios eachyear. One newer asset class we’ve been evaluating is known as private debt. Without going into the specifics of any specific fund, let’s cover the basics of this asset class and why it is garnering attention.

What is Private Debt?

Private debt (also known as private credit) is comprised of direct loans made to U.S. middle-market companies bynonbank lenders. Borrowers typically have annual profits in the $10-100 million range and are similar in size to small and mid-cap companies in publicly traded equity markets.[1] The word “private” refers to the fact that these loans are not publicly tradeable and are meant to be held to maturity. As a result, lenders are rewarded by an illiquidity premium that results in higher yields than most traditional bonds.

Direct loans have been a rapidly growing area of the investment universe in recent years, and direct lending increased 250% from its $400 billion size in 2019. Larry Swedroe, Director of Research for The BAM Alliance, explained in a recent blog, “The enactment of the Dodd-Frank Act in 2010 made it increasingly expensive for small banks to operate, cutting off their supply of loans to small and mid-sized companies. As a result, private debt funds stepped in to fill the gap.” [2]

Some other central banks have begun to raise rates as well — to fight inflation and offer better yields on their own securities. But the strength of the U.S. economy allows the Fed to push rates higher and faster, which is likely to maintain the dollar's advantage for some time.

Borrowers are often private equity firms that need flexible, consistent access to credit. According to Stephen L. Nesbitt in his 2023 edition of Private Debt: Yield, Safety and the Emergence of Alternative Lending, roughly 75% of direct loans are backed by private equity sponsors. [3]

The private debt universe covers a wide spectrum of risk, with senior loans providing the highest level of protection for the lender. Some characteristics of senior loan private credit funds:[4]

- Secured – “Senior” means that the lender is first in line in the case of default, and typically, loans are backed by the cash flow and general assets of the borrower.

- Floating interest rates – interest rates are variable meaning they adjust as their benchmark rate changes.

- Higher yields –an illiquidity premium results in higher yields than those typically found in publicly traded bond markets.

- Loan maturity – average loans are five-to-seven years in duration with an average effective life of three years as they are often paid off or refinanced early. That means approximately one-third of loans pay off each year, providing significant liquidity to senior loan funds.

- Loan diversification – private credit funds may consist of thousands of underlying loans which helps reduce the risk for any one borrower.

- Illiquidity – as underlying loans are illiquid and meant to be held to maturity, funds typically allow a redemption option each quarter to investors. Furthermore, funds may limit total redemptions in a single quarter to 5% of the fund’s value. As a result, this type of investment should be considered long-term in nature.

- Lower price volatility – like publicly traded bonds, loans are subject to credit risk. However, since loans are not publicly traded and held to maturity, they have less price volatility than publicly traded bonds.

- Leverage – some funds may use leverage to seek increased returns and/or to facilitate loans or redemptions more easily.

Why Consider Private Debt in a Diversified Portfolio?

With most of its investment history occurring in the last 15 years, private debt is still a relatively new asset class. As a proxy for the asset class, the Cliffwater Direct Lending Index (CDLI) covers over 8000 loans in the private debt universe with performance history going back to 2004.[5] As Nesbitt details in his book Private Debt: Yield, Safety and the Emergence of Alternative Lending, this private debt index has demonstrated high risk-adjusted returns when compared with stocks and bonds.

Furthermore, he illustrates that private debt has exhibited a relatively low correlation with stock and bond markets. When stress tested during the market disruptions of 2008 (the global financial crisis) and 2020 (Covid), private credit still exhibited relatively low volatility compared with stocks and publicly traded bonds.[6]

As Swedroe concluded recently, “…for those investors who don’t need daily liquidity for at least some significant portion of their portfolio (likely true for almost all investors), the illiquidity premium, while not a free lunch, can be viewed as a ‘free stop at the dessert tray.’” [7]

Other Considerations?

Private debt consists of loans that are meant to be held to maturity. As a result, funds are not buying and selling loans/bonds like in publicly traded markets. As a result, investors should consider any investment in private debt a long-term one.

While private debt as an asset class may have attractive characteristics, manager selection is crucial. Managers can target varying degrees of risk in their loans, such as diversifying among sectors or concentrating loans in a single sector. Funds may hold a small number of loans (100 or less), while others may hold several thousand. Large, experienced lenders may also have pricing efficiencies that allow them to charge lower fees to investors.

Private debt isn’t for every investor, and every private debt fund isn’t created equal. We recommend working with a fiduciary advisor who understands your specific situation and can help explain your options.

Stay patient, my friends.

References

1. Nesbitt, S.L. (2023). Private debt: yield, safety and the emergence of alternative lending (2nd ed.) (Chapter 1). Wiley Finance.

2. Swedroe, L. (January 18, 2023). Is private debt worth considering as an (alternative) asset class in client portfolios? Nerd’s Eye View. https://www.kitces.com/blog/private-debt-funds-returns-general-partners-fees-strategies-performance-risk/

3. Nesbitt, S.L. (2023). Private debt: yield, safety and the emergence of alternative lending (2nd ed.) (Chapter 3). Wiley Finance.

4. Nesbitt, S.L. (2023). Private debt: yield, safety and the emergence of alternative lending (2nd ed.) (Chapter 1). Wiley Finance

5. Swedroe, L. (January 18, 2023). Is private debt worth considering as an (alternative) asset class in client portfolios? Nerd’s Eye View. https://www.kitces.com/blog/private-debt-funds-returns-general-partners-fees-strategies-performance-risk/

6. Nesbitt, S.L. (2023). Private debt: yield, safety and the emergence of alternative lending (2nd ed.) (Chapter 3). Wiley Finance.

7. Swedroe, L. (August 22, 2022). Comparing corporate debt mutual funds. Advisor Perspectives. https://www.advisorperspectives.com/articles/2022/08/22/comparing-corporate-debt-mutual-funds

Learn more about Eric Hutchens

Hello! I’m Eric, the president and chief investment officer at Allodium Investment Consultants, located in Minneapolis, MN. I am dedicated to helping clients achieve their unique goals through designing tax-efficient investment strategies and comprehensive financial planning. In my spare time away from the office, I enjoy relaxing at my cabin in northwest Wisconsin with my wife, two sons, and two rescue dogs. I have also volunteered with my church, serving on the elder board and as a youth group leader.

The information provided is for educational purposes only and is not intended to be, and should not be construed as, investment, legal or tax advice. Allodium makes no warranties with regard to the information or results obtained by its use and disclaim any liability arising out of your use of or reliance on the information. It should not be construed as an offer, solicitation or recommendation to make an investment. The information is subject to change and, although based upon information that Allodium considers reliable, is not guaranteed as to accuracy or completeness. Past performance is not a guarantee or a predictor of future results of either the indices or any particular investment.