The Financial Planner

The New SECURE Act 2.0 Has Many New Options for Planners and Savers

Congress has packed a lot into the SECURE Act 2.0 recently signed into law at the end of 2022. We are highlighting a few planning opportunities that are actionable in 2023, and some starting in 2024. We’ll cover many of the other future rule changes and enhancements that may be of interest from time to time in 2023.[1-2]

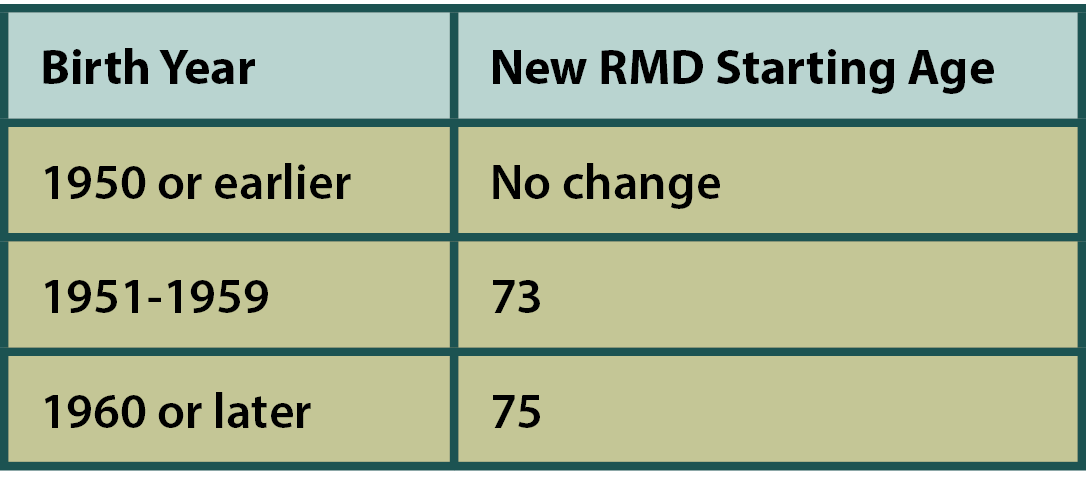

RMD Starting Age Moved Back Again

Congress has again pushed back the age at which you must begin taking RMDs (required minimum distributions) from your IRA as per the chart. This means that in 2023 no retirement account owners will have to start RMDs based on their age. The good news for planning purposes is that you will have more years to consider making Roth conversions prior to beginning RMDs. With a Roth conversion, you pay income taxes on the amount converted from a traditional IRA to a Roth. However, unlike an RMD, you decide on the amount of income you want to take. This allows you to distribute just enough income from your IRA to fill up lower tax brackets. Once in the Roth, all future growth and distributions are tax free.

RMD Mistakes have Lesser Penalties

Starting this year and going forward, the 50% penalty for missing an RMD or not taking enough of a distribution is reduced to 25%. Plus, if the shortfall is made up within a “correction window”, the penalty is further reduced to only 10%. The correction window (in most instances) starts January 1 of the year following the missed RMD and ends December 31 of the second tax year after that.

New Planning Opportunity: Transferring 529 Plan assets to a Roth IRA

Effective in 2024, beneficiaries of 529 plans will have the option of transferring assets from their 529 plan to a Roth IRA in their name, free of taxes and penalties. There are some rules to follow:

- The 529 plan must have been maintained for 15 years or longer to be eligible.

- Only contributions made at least 5 years before the transfer (and associated earnings) are eligible to be transferred.

- It must be a direct transfer from the 529 plan to the Roth IRA (the beneficiary cannot receive a check from the 529 plan and then deposit it later into the Roth).

- The amount transferred is subject to the annual IRA contribution limit, less any regular IRA contributions made that year.

- The beneficiary must have earned income, but Roth IRA contribution income limits do not apply.

- There is a $35,000 lifetime maximum on the amount that can be transferred.

We recommend opening a 529 plan for your children or grandchildren now to get the 15-year clock started. For example, if your child or grandchild is born in 2023, and you open and fund a 529 plan for him or her by age 10, by age 16 when some teenagers start jobs the 529 account would be eligible to be rolled over into a Roth IRA as long as the teenager had earned income. Doing this over as many years as needed to convert the full $35,000 to a Roth IRA would give the adult child many years of tax-free growth that could be accessed later in life for tax-free retirement income.

One obvious question is what happens if you change the beneficiary along the way to another family member, or even to yourself? Does the 15-year clock start again? Experts are not entirely sure at this point, but many are saying that a beneficiary change will not restart the clock. By opening an account now, even with a small contribution amount, you can put money aside in a tax advantaged vehicle that could benefit family members down the road whether they go on to higher education or not.

2023-Only and Future Planning Opportunity: Qualified Charitable Distributions (QCDs)

First, one key thing that did not change was the age at which you can begin to make QCDs; it remains at 70½. QCDs did receive one future enhancement and one “maybe” one-time enhancement/option with several rules and stipulations to go with it. The one clear-cut enhancement is that the maximum annual QCD of $100,000 per person will now be indexed for inflation beginning in 2024.

The “maybe” enhancement/option is that for 2023 only, you can use a QCD to fund what is called a split-interest entity. These are better known as Charitable Remainder Unitrusts (CRUTs), Charitable Remainder Annuity Trusts (CRATs) or Charitable Gift Annuities (CGAs). “Split interest” refers to the fact that such entities provide a benefit to both the charity and the individual IRA owner. The charity receives the remainder interest, and the IRA owner receives an income stream for life or a fixed period not to exceed 20 years. The rules (which include some troublesome catches) are as follows:

- The maximum contribution is $50,000 per entity, subject to the $100,000 QCD overall maximum.

- You cannot make the contribution to an existing CRUT or CRAT; it has to be made to a new CRUT or CRAT that is exclusively funded by the QCD. For most people, setting up a CRUT or CRAT and funding it with only $50,000 may not be worth the time and trouble.

- All distributions from a CRUT or CRAT funded by QCDs will be taxed as ordinary income, not as capital gains, qualified dividends, etc. as from a regular CRUT or CRAT.

- The income beneficiaries of the split-interest entity can only be the IRA owner and spouse.

- That leaves the charitable gift annuity to consider and it may be the best option. CGAs are created and operated by charities such as large non-profits and some universities. You make the QCD contribution, and the charity will set up an annuity that pays you a fixed income payment, usually for life. Income payments would be required to begin no less than one year after funding and must be at a fixed rate of 5% or greater. Additional rules apply. This option would change a $50,000 fully taxable RMD in 2023 into a stream of much smaller taxable annuity payments while benefiting one’s favorite charity or university.

If any of these planning ideas are of interest to you or one of your family members, please contact your Allodium Investment Consultants advisor to obtain more information and to learn how it might be of benefit to you.

References

1. Levine, J. (December 28, 2022). Secure Act 2.0: Later RMDs, 529-To-Roth Rollovers, And Other Planning Opportunities. Kitces’ Nerd’s Eye View. https://www.kitces.com/blog/secure-act-2-omnibus-2022-hr-2954-rmd-75-529-roth-rollover-increase-qcd-student-loan-match/

2. Levine, J. (2023). Secure Act 2.0: Retirement Planning Opportunities and Challenges. Kitces Monthly Webinar Series.

Suzanne Tudor

Suzanne has over 35 years of experience in financial services, retiring in 2024. She was a senior investment consultant and director of financial planning at Allodium Investment Consultants, located in Minneapolis, MN. Suzanne was passionate about helping families and business owners to strategically develop and carry out their financial, legacy and philanthropic plans. Since retiring, Suzanne has had extra time for activities she loves, such as spending time with her family and making DIY home improvements.

The information provided is for educational purposes only and is not intended to be, and should not be construed as, investment, legal or tax advice. Allodium makes no warranties with regard to the information or results obtained by its use and disclaim any liability arising out of your use of or reliance on the information. It should not be construed as an offer, solicitation or recommendation to make an investment. The information is subject to change and, although based upon information that Allodium considers reliable, is not guaranteed as to accuracy or completeness. Past performance is not a guarantee or a predictor of future results of either the indices or any particular investment.