The Informed Investor

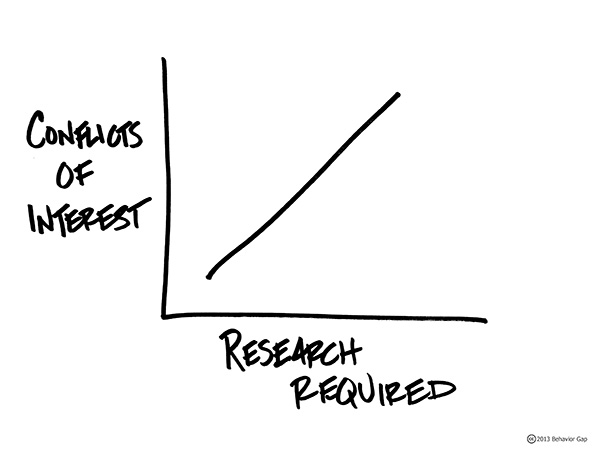

Investors are eager to find sources of objective advice. Unfortunately, investment advisors often may have inherent conflicts of interest with the investor. Biased advice is something that investors need to learn how to identify if they want to avoid it.

The Prudent Practices for Investment Advisors defines a global fiduciary standard of excellence for professionals who provide investment advice, including financial advisors, broker-consultants, investment consultants, wealth managers, financial consultants, trust officers, financial planners, and fiduciary advisers. This fiduciary handbook addresses conflicts of interest in one of their 21 Prudent Practices. As investment advisors have a duty of loyalty to their clients, Prudent Practice 1.4 requires that the investment adviser identify all conflicts of interest and then address these conflicts in a manner consistent with their duty of loyalty to the client. Practice Criteria 1.4.2 further stipulates that conflicts of interest are to be avoided when possible and always when required by law, regulation, and/or governing documents.

If investment advisors are to avoid conflicts of interest with their clients, we need to identify the various types of conflicts of interest between the investor and the investment advisor. What does a conflict of interest look like and sound like? How is an investor supposed to be able to identify a conflict of interest with their investment advisor? How is an investment advisor to avoid conflicts of interest with the investor when they themselves often cannot identify a conflict of interest with the investor?

These are the questions that The Informed Investor blog is planning to answer. The Informed Investor blog is going to identify and explain common conflicts of interest between the investor and the investment advisor. We want to show you what a conflict of interest looks like so you will be able to recognize it yourself when you see it in the real world. We hope that you enjoy our laser-like focus on an arcane subject that both warrants our attention and promises the benefit of more objective investment advice for the consumer. Please feel free to share any ideas that you might have about conflicted investment advice that you would like for us to address in this endeavor.

Learn more about David Bromelkamp

Hello! I’m Dave, the founder and chief executive officer of Allodium Investment Consultants, located in Minneapolis, MN. I am also the author of AdvisorSmart for the Individual Investor: Your Guide to Selecting a Financial Advisor to Get Better Financial Advice. I enjoy educating individual and institutional investors about financial planning and investing. When I’m not helping people make investment decisions, I enjoy traveling, hiking and spending time with my wife and family.

The information provided is for educational purposes only and is not intended to be, and should not be construed as, investment, legal or tax advice. Allodium makes no warranties with regard to the information or results obtained by its use and disclaim any liability arising out of your use of or reliance on the information. It should not be construed as an offer, solicitation or recommendation to make an investment. The information is subject to change and, although based upon information that Allodium considers reliable, is not guaranteed as to accuracy or completeness. Past performance is not a guarantee or a predictor of future results of either the indices or any particular investment.