What Does a Strong Dollar Mean for the U.S. Economy?

In late September 2022, the U.S. dollar hit a 20-year high in an index that measures its value against six major currencies: the euro, the Japanese yen, the British pound, the Canadian dollar, the Swedish krona, and the Swiss franc. At the same time, a broader inflation-adjusted index that captures a basket of 26 foreign currencies reached its highest level since 1985. Both indexes eased slightly but remained near their highs in October.[1–2] Intuitively, it might seem that a strong dollar is good for the U.S. economy, but the effects are mixed in the context of other domestic and global pressures.

World Standard

The U.S. dollar is the world's reserve currency. About 40% of global financial transactions are executed in

dollars, with or without U.S. involvement.[3] As such, foreign governments, global financial institutions, and multinational companies all hold dollars, providing a level of demand regardless of other forces.

Demand for the dollar tends to increase during difficult times as investors seek stability and security. Despite

high inflation and recession predictions, the U.S. economy remains the strongest in the world.[4] Other countries are battling inflation, too, and the strong dollar is making their battles more difficult. The United States recovered more quickly from the pandemic recession, putting it in a better position to weather inflationary pressures.

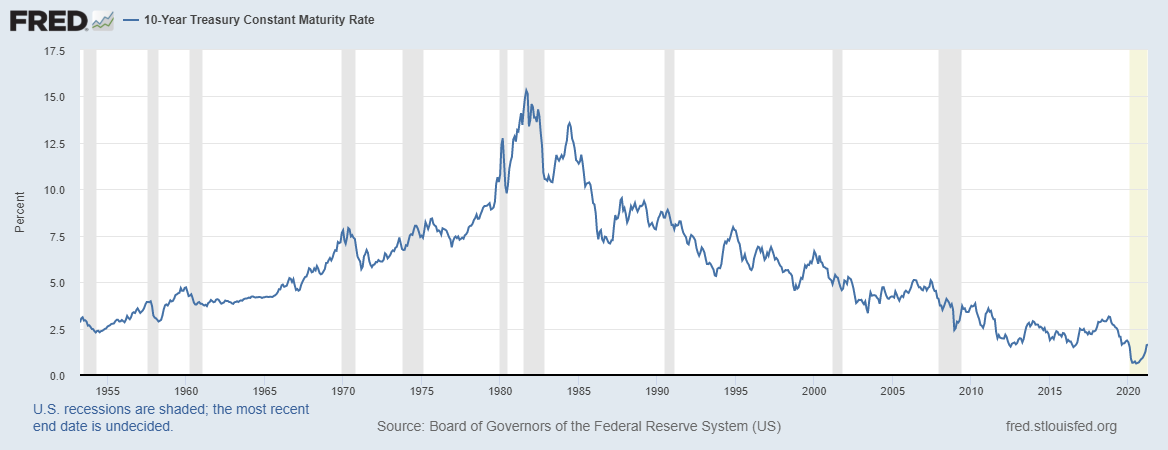

The Federal Reserve's aggressive policy to combat inflation by raising interest rates has driven demand for the dollar even higher because of the appealing rates on dollar-denominated assets such as U.S. Treasury securities.

How do you invest your money over the long-term? If you’ve read much of our work, you’ve probably noticed we embrace evidence-based investing. But what does that mean?

How do you invest your money over the long-term? If you’ve read much of our work, you’ve probably noticed we embrace evidence-based investing. But what does that mean?

Over the last two decades, the U.S. stock market has repeatedly been making new highs. As a result, this has been a relatively common question that I’ve heard from clients throughout my career. For a client with money to invest, it’s a natural one to ask…”if the market is at an all-time high, why should I invest now?“ And this question is relevant today. On February 19, 2020, the S&P 500 index hit an all-time high, closing at 3,386 as part of a historic bull run that began on March 9, 2009. After a dramatic drop of 34% in March due to the COVID-19 pandemic, the U.S. stock market quickly recovered and the S&P 500 made a new all time-high on August 18, 2020.1

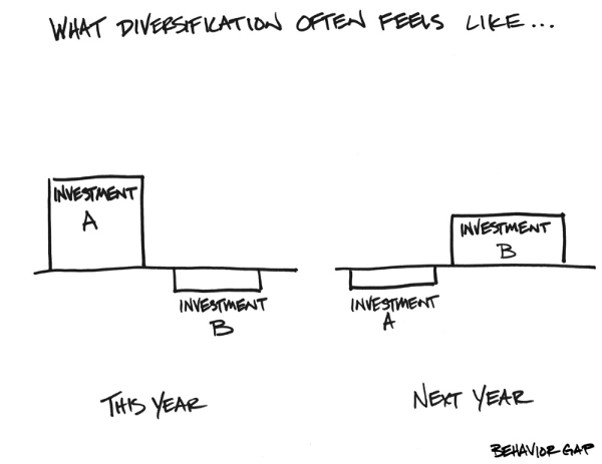

Over the last two decades, the U.S. stock market has repeatedly been making new highs. As a result, this has been a relatively common question that I’ve heard from clients throughout my career. For a client with money to invest, it’s a natural one to ask…”if the market is at an all-time high, why should I invest now?“ And this question is relevant today. On February 19, 2020, the S&P 500 index hit an all-time high, closing at 3,386 as part of a historic bull run that began on March 9, 2009. After a dramatic drop of 34% in March due to the COVID-19 pandemic, the U.S. stock market quickly recovered and the S&P 500 made a new all time-high on August 18, 2020.1  Over the last several decades, we’ve seen strong returns from large U.S. companies and a question that many clients have asked is: “Why continue to diversify? Couldn’t we just buy an S&P 500 index fund and get better returns?”

Over the last several decades, we’ve seen strong returns from large U.S. companies and a question that many clients have asked is: “Why continue to diversify? Couldn’t we just buy an S&P 500 index fund and get better returns?”